Exploring AI’s Powerful Expansion And Its Future Across Industries

- 6 mins read

If you own a smartphone, drive an electric vehicle (EV), or have ever undergone an MRI scan, you are relying on a piece of technology that is currently at the center of a massive geopolitical tug-of-war: Rare Earth Magnets.

For years, the global supply chain for these tiny but powerful components has been dominated by a single player China. But as of late 2025, India has officially entered the chat.

In a move that signals a major shift in industrial strategy, India approved a massive 73 billion rupee ($800 million) plan in November 2025. The goal? To cut dependence on China and build a self-reliant ecosystem for permanent magnets.

But as with all ambitious government schemes, the devil is in the details. Is this a realistic leap toward sovereignty, or a rocky road paved with good intentions? Let’s dive into the reality of India's magnet mission.

To understand the gravity of this move, we have to look at the numbers. Currently, India imports a staggering 80-90% of its magnets and related materials from China. This isn't just an economic issue; it's a national security vulnerability.

From wind turbines to defense equipment, modern infrastructure cannot function without these magnets. The vulnerability was laid bare recently when trade disputes led to tightened exports, hitting Indian EV makers and electronics firms hard. The lesson was clear: without a sovereign rare earths strategy, the entire industry is a hostage to geopolitics.

India’s new plan is clever. Instead of trying to build the entire rare earth ecosystem from scratch immediately which is expensive and incredibly time-consuming the government is focusing downstream. The aim is to incentivize manufacturers to produce 6,000 tonnes of permanent magnets per year within seven years.

While the ambition is commendable, industry experts and scientists are urging caution. The road from a government policy paper to a functional high-tech magnet factory is riddled with potholes.

Here are the three major hurdles standing in India's way:

1. The Expertise Gap

Money can buy machinery, but it cannot buy decades of institutional knowledge overnight. Countries like Japan, South Korea, and Germany have spent years refining the complex art of magnet-making.

As Neha Mukherjee from Benchmark Mineral Intelligence notes, India has "virtually no commercial-scale experience." While the new scheme is a step in the right direction, creating a workforce and building proprietary capabilities will take time. You cannot simply invest 73 billion rupees and expect a world-class product without a strong background in research and development.

2. The Mining Paradox

This is perhaps the most frustrating irony for India. The country holds the world’s third-largest rare earth reserves roughly 8% of the global total mostly sitting in the coastal sands of states like Kerala, Odisha, and Tamil Nadu.

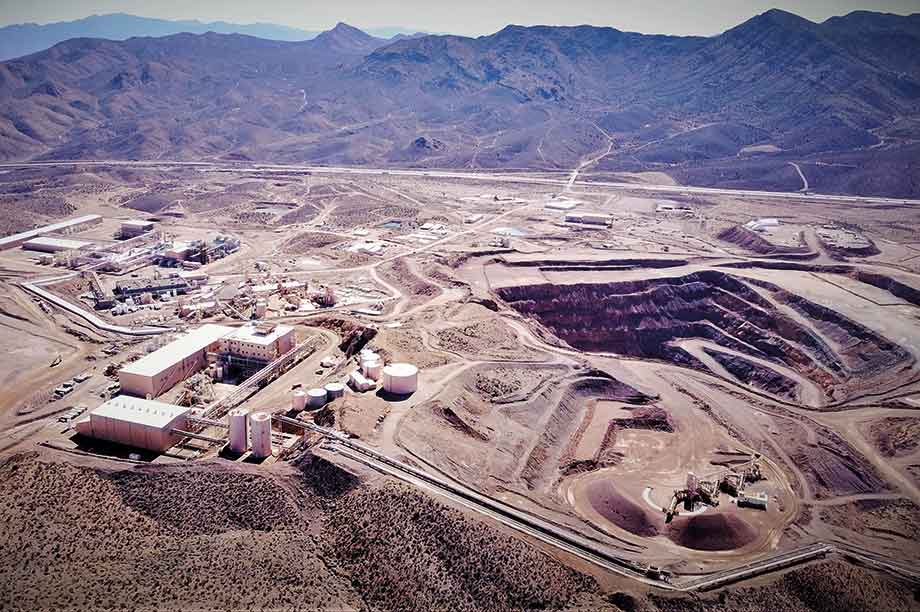

However, having the resources and extracting them are two different things. India accounts for less than 1% of global mining. As of now, only one mine in Andhra Pradesh is operational. To protect domestic supply, India even reportedly suspended exports from state miner IREL in June 2025.

There’s more to life than simply increasing its speed.

By Udaipur Freelancer

But here is the catch: even if India mines its own sand, it faces a chemistry problem. Indian reserves are rich in "light" rare earths like neodymium but lack extractable quantities of "heavy" elements like dysprosium and terbium. These heavy elements are essential for high-performance magnets used in EVs.

The result? Even if magnets are made in India, the raw materials for them might still have to be imported from China.

3. The Scale Problem

The projected target of producing 6,000 tonnes of magnets by the early 2030s sounds impressive until you look at consumption data. India already consumes an estimated 7,000 tonnes annually.

With the demand expected to double in the next five years, the domestic production target might be too conservative. As experts warn, if we don't scale capacity, the problem doesn't get solved we remain dependent on imports to fill the gap.

The Economic viability

There is one final hurdle: Price.

Chinese magnets are cheap because of their massive scale and established supply chains. If Indian-made magnets turn out to be significantly more expensive, will domestic buyers make the switch?

Unless the government provides incentives for the buyers (not just the manufacturers), commercially minded companies may continue to buy the cheaper imported option, undermining the local ecosystem.

India’s quest for rare earth magnets is not just an industrial plan; it is a necessity for future-proofing the economy. The introduction of this scheme shows that the government is serious about ending its reliance on a single foreign power.

However, as Rajnish Gupta from EY India points out, the "timing of the controls came as a surprise" to many countries, including the EU and Australia, who are all scrambling for alternatives.

India has the reserves and the entrepreneurial energy. The challenge now is bridging the gap between raw ambition and technical reality. It will be a long grind, but for the sake of India's tech sovereignty, it is a risk worth taking.

What do you think? Can India catch up to China's decades-long head start in rare earth technology? Let me know in the comments below!

Recommended for you

Must-See Art Exhibitions Around the World This Year

The Revival of Classical Art in a Digital Age

Breaking Down the Elements of a Masterpiece Painting

The Revival of Classical Art in a Digital Age